Archive

Work experience

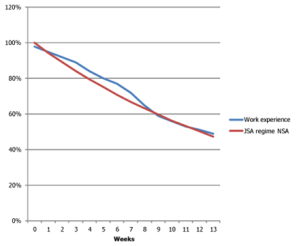

Work experience programmes to help get the unemployed back into regular jobs have a long and somewhat chequered past. They have two distinct and offsetting effects; first the work experience itself is valuable. It gives an opportunity for the unemployed person to signal good work habits, including turning up on time and self-motivation when at work. These are the basics that employers want, after skills and experience. A decent reference from another employer is a big plus when looking for work. Obviously this is more important for those who have been out of work for a long time, or for young people with little previous work experience. However, whilst a person is on a work experience programme job search activity diminishes. The participant is working which simply reduces time available, but it is as important that they focus on trying to impress the firm they are based in, in the hope of being kept on. This is called ‘Lock In’ in the jargon of such schemes. These two effects are clearly visible in the Figure below (taken from the CESI website http://www.cesi.org.uk/blog/2012/mar/work-experience-more-be-done). It shows the proportion of participants in the government’s current Work Experience programme who are still claiming benefits week by week once they start participating (the blue line), compared with those who do not participate (the red line). For the duration of the placement, the first eight weeks, the proportion still claiming is higher by about 5% and then they rapidly catch up. So whilst they are on the experience programme job entry falls but once it has ended the positive effects start to kick in.

In this comparison the net effect is zero. This doesn’t definitively suggest that the programme has no beneficial effects for those participating, as we can’t be certain that those joining are not those who would have found securing work harder. They could of course be the more keen participants, or those in places where more firms offer placements, we simply can’t tell. However, this story of ambiguous effects with little overall impact on people’s chances of securing jobs has been the norm of Work Experience programmes since the 1970s. Unless, the design actively tries to minimise the adverse effects on job search and maximise the positive part of the work experience.

The first key ingredient is to maintain and support job search throughout the placement. That means requiring and monitoring the participant’s job search activity, as is the case when people are on unemployment benefits. Furthermore, the support services that welfare to work providers deliver to the long-term unemployed, such as CV writing and job interview techniques need to be in place to make the most of the experience. Finally, the agents delivering the placement, both the provider and the firm, need to care about the person getting a job after the placement. The easiest way to guarantee this is a bonus payment if the person is kept on by the firm or another job is found shortly after completing the placement. Small firms especially have a lot of contacts they can use to help place someone. Hence it is generally most valuable for private or third sector firms to house the participant rather than in the public sector.

Labour’s New Deal programme launched a decade ago now, had some of these ingredients but in sequence rather than all at the same time. There was a Gateway phase before the placement for support and intense job search, and again at the end in a Follow-through phase, but not when actually on the experience part. However, it didn’t have any outcome related payment for firms or charities providing the experience. By comparing those aged 24 who joined the scheme at 6 months, with those aged 25 who had to wait until 1 year, we got a sense of its effectiveness. A study by John van Reenen (LSE) showed clear job entry gains for participants, although it didn’t assess how long the gains lasted as the older group also joined the programme.

The current Work Experience programme for under 25s starts much earlier at just 3 months, which means there are more potential participants and many more will find work quickly without help. For this reason the government is keeping costs down to a minimum. The placements are not paid and no support services are provided, no job search monitoring is in place and there are no bonus payments for firms who take participants on. Hence it should be no surprise that the scheme appears to be making little or no difference.

Labour has just launched its ideas for a more intensive, 6 month paid programme starting after 12 months on unemployment benefits. These are a much smaller group with much greater need; people who go on to have very damaged working lives well in to their 40s unless they can get attached to long-term stable employment. With signs of intelligent design, the programme has all the key ingredients for making a difference, except outcome payments for the firms. Participants will have a support service provider whilst on the programme who is only paid on the basis of getting the person into work, the work experience is part-time to leave time for job search and as when receiving benefits normally, active job search is monitored and sanctions will apply if it is not undertaken. So the scheme has a decent chance of making a sufficient difference to cover its costs. But the other issue, apart from there being no bonus payment to firms getting participants into work, is that it is drawn very narrowly. By requiring a person to be on unemployment benefits for as long as a year means that many cycling between short term jobs and unemployment are missed. Those leaving school at age 16 or 17 who don’t get work are not entitled to benefits, and will still have to wait a year (until they are 19) before help kicks in. There is also no help for the 16 and 17 year old unemployed. So, it is a good first instalment but more will be needed to end long-term youth unemployment.

The cost of youth unemployment

Paul Gregg and Lindsey Macmillan

In hard times, young people face two hurdles to finding work. First, firms tend to hold onto their existing experienced staff but stop recruitment to reduce their workforce. This collapse in new vacancies hits young people hardest. Second, with more unemployment comes more choice of potential employees for firms who are hiring. Firms favour previous experience placing young people in a catch 22 situation of not being able to get the experience they need to get work because they can’t get the work in the first place. For the least educated or those who are unlucky enough to experience long periods out of work now, it is increasingly hard to get that break that opens the door to the labour market.

As the number of youths who are out of work continues to rise the exchequer is left counting the cost. Each 16-17 year old in receipt of benefits costs an average of £3,660 a year whilst each unemployed 18-24 year old who claims costs an average of £5,600 a year. Even though many young people don’t claim benefits, just 19% of 16-17 year olds not in education or employment and 65% of 18-24 year olds with the sheer number of young people out of work, plus the additional tax and NI revenue lost through the lack of earnings, the numbers are non-negligible. In total, the current cost of youth unemployment to the exchequer is £5.3 billion per year. The productivity loss to the economy, often calculated as the wage foregone to measure the output lost, is £10.7 billion. The large numbers not claiming benefits and the low value of benefits relative to potential earnings makes an important point that work incentives are very strong for this group.

On top of these current costs, there are also long-term scars to youth unemployment in the form of future unemployment spells and lower wages. We can see from previous generations’ experiences of youth unemployment that the longer the period spent out of work in youth, the more time spent out of work later in life and the lower potential wages were when in work. This evidence on the future costs of youth unemployment comes from two UK birth cohorts that track all babies born in a window for the rest of their lives. By chance, the participants in the first cohort were aged 21 when the 1980s recession hit and in the second cohort, the participants were aged 20 when the 1990s recession hit. Around one in five young people in the first cohort spent over 6 months out of work before age 23, and it was similar in the second. Furthermore these people spent about 20% of their time unemployed 5 years later and 15% even 12 years later.

For males in the second birth cohort, an extra month out of work before age 25 raised the proportion of time out of work between age 26 and 30 by three quarter of a per cent; an extra year out of work in youth led to 10 months more unemployment later in life. It is a very similar story for wages with an extra month unemployed when young associated with 1% lower wages in their early thirties. It’s possible that these legacies may not reflect just the pure effect of youth unemployment but also that those experiencing more unemployment are less well educated and come from deprived backgrounds. The great advantage of the birth cohort studies is that so much is known about the young person’s childhood from their education to their attitudes and beliefs, their health, their wider circumstances and almost as much is known about their parents. The evidence suggests that about half of the later lower wages and higher unemployment exposure stems from these background differences between people and about half is a result of the unemployment itself.

The cost to the individual’s future is therefore large. However, it doesn’t end there. There is also a future cost to the public purse in terms of future benefit claims and tax revenues lost from lower earnings as a result of this scarring. Estimates from the second birth cohort suggest that the average unemployed young man will cost the exchequer a further £2,900 in future costs with the average unemployed young woman costing £2,300 a year. Aggregating these up in the context of the current youth unemployment crisis leads to further future costs to the exchequer of £2.9 billion. The future productivity losses in terms of output lost are estimated to be £6.7 billion. If we add the exchequer costs together to give the combined future and current costs of youth unemployment (discounted to adjust future costs to be equivalent to today’s) the total cost to the exchequer is therefore £28 billion. These numbers suggest that doing nothing about youth unemployment is and will continue to cost us dear.

Disability benefit claims

Department for Work and Pensions figures released this week suggest that only 7% of applicants for the new disability benefit, Employment Support Allowance (ESA), during the two years since its inception, are found unfit for work. The implicit suggestion is that the previous regime was widely abused by ‘scroungers and malingerers’. Yet the total number of claims for disability related workless benefits is almost exactly the same, at 2.6 million, in the latest data (November 2010) as it was in 2008, when the new benefit started. Even among claims less than two years old and hence all assessed under the new regime there are 640,000 claimants, which is exactly the same as in 2008. So, how can the impression of a big crackdown on claims under the new test, and the absence of any decline in numbers claiming be reconciled?

The answer is three fold. Firstly, although only 7% of new applicants go on to be deemed unfit for work, another 17% are eligible for ESA, but deemed that with the correct support and improvements in health they may get back into work. ‘May’ being the important word here. I designed the structure of support for this group under the ‘Work Related Activity Group’ banner, which will be delivered under the new Work Programme. How successful it will be is yet to be demonstrated. So, 24% of new claims go on to be eligible for ESA, not 7%.

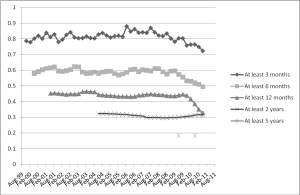

The second key point is that a large number of applicants never got onto Incapacity Benefits (IB), the forerunner of ESA, either. Some people simply got better before the assessment phase was completed and so never got tested, or were denied access through the test applied at the time. People start a claim for disability related benefits but begin in an assessment phase, during which they receive the same benefits as they would for unemployment. It is only after this is completed, at around 13 weeks, that the recipient receives the eligibility decision as to whether they move on to the full ESA benefit. A lot of people withdraw before the test occurs and always have; 36% of applicants in the new figures. A useful guide to this would be what proportion of claims under 13 weeks go onto the main benefit. However, as so many claims go to appeal, during which time people remain as though they are still in the assessment phase, a better picture emerges after 6 months. The figure below highlights the survival rates for claims before and after the new ESA regime was introduced in late 2008. It shows the proportion of claims under 13 weeks old, and hence in the assessment phase, which are still live a further 3 months, 6 months and so on after their commencement. After 3 months some 72% of applicant’s claims are still live and after 6 months this falls to 50%. Of key importance here is that this was around 80% and 60% respectively under IB pre-October 2008. Hence, ESA has reduced the numbers of applicants reaching at least 6 months duration by 10%, and this appears to persist through to the longest duration data we have. So the new regime is leading to around 10% fewer people, after the appeals process is completed, being passed as eligible for ESA. A story far removed from just 7% being found unfit for work.

The third reason this has not had any effect on the total number of claims under 2 years duration, and thus assessed under the new test, is that the total number of new claims has risen from around 130,000 per quarter in 2008 to around 160,000 now. This is almost certainly as a result of the recession but past experience suggests it will take quite a long time to abate fully. So, between 1 and 2 years duration we now have the first quarter of data that is fully under the new regime. After all the assessment and appeals have been completed we can derive that the number of claims has fallen to 206,000 from about 235,000 prior to the reform. This is around 12% lower, but this is currently offset by shorter duration claims. As time progresses and the impact of the recession diminishes the new ESA tests will make a clearer difference to the total number of claims. However, it will be a long time before this is very visible. What will be more important over the next 3 years will be the re-testing of existing IB claimants, as well as the removal of eligibility to ESA for those claiming for more than 1 year and who are not eligible for means tested benefits.

Figure 1 Proportion of Claims of 0-13 weeks duration that are still live after intervals specified

Radical Welfare Reform

Iain Duncan Smith (IDS), as Secretary of State for Work and Pensions has articulated the need for a radical overhaul of the welfare system. His assertion, along with George Osborne, that the welfare system is broken deserves some scrutiny, and I intend to discuss this in my next blog. Here the options and problems with radical reform are discussed. IDS has argued that the system is too complicated with a huge number of different benefits; he states there are 50 separate benefits and tax credits, but I can only think of about 10 substantial ones, and that work incentives are too low because of excessive rates of benefit withdrawal when people earn more. IDS intimated, soon after the election, that three options were being considered – a Negative Income Tax system that integrates all major aspects of the welfare and tax system, a Universal Credit that integrates all major aspects of the welfare system but keeps them separate from the tax system and an integrated taper that does merge all the benefits but makes sure all means testing of welfare benefits operates at a single combined withdrawal rate for all benefits.

The first major problem with integration of welfare, tax credits and taxes is whether you are considering the individual or the family. Income taxes are individually assessed whilst most benefits are family based. Thirty years ago this was more mixed with income taxes being based on joint income for couples and many benefits being based on own contribution record and assessed against own income only, though the residual Supplementary Benefit system was assessed on joint income. In the 1980s with the elimination of most NI benefits full integration of taxes and benefits might have been doable. But now a single Negative Income Tax system has the difficult choice of making the entire system based on own income only or family income only. Forcing taxation back to being jointly assessed for couples would cause outrage from many women and high earner couples as their tax bill would rise considerably. Going the other way and making benefits individualised would lead to large costs as many people ineligible because of their working partner would be able to claim. Given these two huge problems the government seems to now be downplaying this idea and focusing more on the Universal Credit.

A Universal Credit would take all income related benefits and tax credits for working age people into a single system with a single withdrawal rate as earnings rise. This withdrawal would have to be based on joint family income. However the universal credit does still need to address the residual entitlements to individual contributory benefits, mainly short term Job Seekers Allowance (for 6 months) and much longer entitlement to incapacity related benefits (5 years). Mimicking these individual elements within the new Universal Credit would add considerable complexity, undermining the very logic of the reforms. Hence the expectation must be that the remaining contributory elements in benefit entitlement would go. This saves money but also leads to a lot of people who lose entitlement to support.

There are three additional fundamental design features that are problematic when moving to a Universal Credit. First, many benefits are supplements for specific additional costs. Housing Benefit (HB), Council Tax Benefit, the higher value of disability benefits to those for job seekers, Disability Living Allowance (DLA) and Attendance Allowance (AA) all reflect payments for large additional costs that only apply to some claimants. A single Universal Credit would not be high enough to meet these additional costs unless it was very generous and thus prohibitively costly. But keeping them as extra payments requiring additional claim details means the new system is just replicating the existing system but rather than being different benefits you have extra supplements. It was this addition of a lot of supplementary elements in the Tax Credit System that led it to being so complex. In my view this is such a profound problem that it will be at least partly fudged. I would expect that Council Tax costs, DLA and AA would stay out of the Credit. However, HB and the higher value benefits for Disability would have to be inside for the reform to be meaningful. So the government could either keep supplements for housing costs and disability, making the system complex or paying a common rate, higher than current basic benefit levels, but way below what current disabled claimants or those eligible to help for housing costs would receive. This producers winners among those with lower need and big losers amongst the most in need of extra financial help – this is a hard story to sell.

The second problem is that different elements of the current system are re-evaluated at different intervals. Most benefits are based on current income, rent etc and are reassessed whenever there is a change of job, family structure and even wages. Tax credits however, are based on last year’s earnings (from NI records) and are only reassessed within year if there is a major change of circumstance. Here there is also different flexibility if incomes rises or falls. Large income rises are tolerated so that there is no recalculation until the next year. However, significant falls in earnings trigger rapid reassessment. Crudely, it seems sensible for out of work benefits to change when people start earning or lose jobs but instant adjustment every time someone works an extra hour a week or gets a pay rise seems unwieldy. At the moment this is partially dealt with, though not without problems, by having separate in and out- of work systems. How a single Credit would navigate this may again make it complex.

Finally, there is the issue that out of work benefits come with some conditionality about activity that claimants must undertake. There are three groupings (although the middle one is not fully operating yet at it only came into existence recently). These mean that job seekers including lone mothers with youngest child aged 10+ are required to demonstrate they actively applying for jobs and are required to take work that is offered, they can also lose benefits for leaving a job through choice. Those with health problem that are not extreme will be required to follow an Action Plan to get them back to work but are not required to look for work on day one and can refuse jobs they do not feel are suitable. Those who are extremely sick/disabled and their carers, plus lone mothers with young children are not required to undertake any activity. Those who only claim in-work benefits such as HB or tax credits are not subject to any conditionality. Broadly speaking, at the moment, once a family is working 16 hours per week they are left on their own. Under a single Credit deciding the appropriate levels of conditionality and the potential to extend conditionality to those who already work 16 hours or more but receive extra financial help represents a problem that could easily created widespread resentment.

So the Universal Credit represents a radical welfare reform. The simpler it is the more it will create a large number of losers even with substantial extra costs to the Treasury. The more complex it is, the less radical a reform it represents and less attractive it becomes. Selling a system with substantial extra costs and a lot of losers will prove very hard. Furthermore, doing it in one big bang may repeat the administrative nightmare that occurred with the more modest integration of three different sources of support for children that occurred with the tax credit system. Hence the government seems to moving forward might by making the reform in chunks. The easiest would to integrate the three main out of work benefits, Job Seekers Allowance, Income Support and the new disability benefit, Employment Support Allowance. The out- going government had already set this in motion with IS being phased out and plans for a Single Working Age Benefit where the disabled would receive higher levels of support. Other and more profound early steps might be to focus on three areas most in need of change, Housing Benefit could be turned into a Housing Supplement based on family size and area lived in rather than rent, a necessary step to keep it easy to calculate and added to either out of work benefits or in-work tax credits. The Childcare Tax Credit, the source of most over payment problems, needs to go the other way and be turned into a simpler childcare subsidy, outside the tax-credit system.